As Lennon and McCartney wrote a half century ago, money can’t buy you love. But in today’s world, where people have come desensitized by ad campaigns and marketing slogans , that maxim needs an update: money can’t even buy you like.

That’s because we’ve entered the ‘Relationship Age’ where the only path for financial planners seeking long-term success is to create authentic customer relationships. Not through old traditional marketing. Old traditional marketing is: interrupting your clients with whatever they are doing. You are disturbing your clients by shoving them your marketing message under his nose.

Before I’ll tell you how te create authentic relationships with new marketing, let me tell you why I think we are entering ‘the Relationship Age’. Here are 4 reasons:

Continue reading

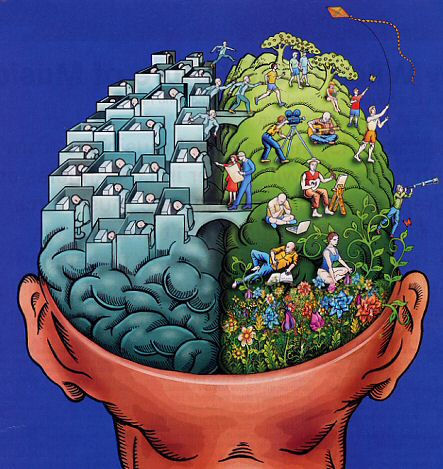

Many financial planners are at risk. They think that they fullfill the needs of their clients by showing the numbers of their financial plan. “The figures should be perfect. It’s in my clients best interest that he sees this”. The numbers are often a priority of the financial planner. Mostly outof compliance-considerations. But also because the planner thinks he’ll persuade his client with those numbers.

Many financial planners are at risk. They think that they fullfill the needs of their clients by showing the numbers of their financial plan. “The figures should be perfect. It’s in my clients best interest that he sees this”. The numbers are often a priority of the financial planner. Mostly outof compliance-considerations. But also because the planner thinks he’ll persuade his client with those numbers.