24 Here Are 5 Seriously Underrated Perspectives for Your Financial Planning Business

“If this is going to last any longer, I’m jumping off the roof”

“If this is going to last any longer, I’m jumping off the roof”

What if your clients become very eager to talk about their financial goals?

And even thank you because you gave them the opportunity to share their story with you?

Imagine your client-to-be comes to you and says:

“I see you are the perfect financial planner for me because of your professional designation. So therefore, I would really like to work with you”

If you have experienced this, then stop reading this article.

Otherwise, you might want to continue.

Are you willing to be open and honest with yourself?

Then let’s begin.

Good financial planners, we’ve long been told, are skilled problem solvers. They can assess people’s needs, analyze their predicaments, and deliver the optimal solution.

But today, when information is ubiquitous, the ability to solving problems matters relatively less.

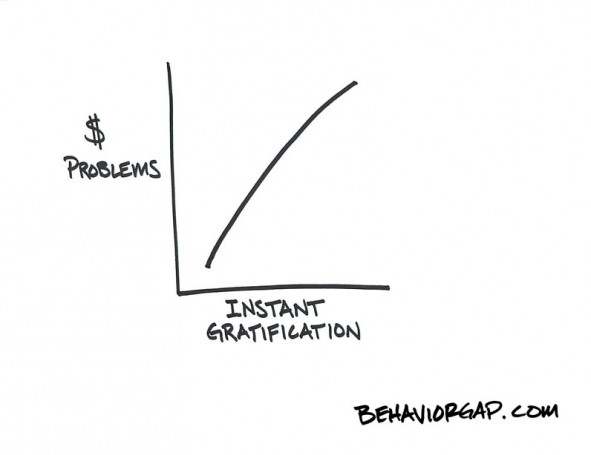

Imagine yourself buying something from the internet. How long do you want to wait before enjoying your purchase?

A day, an hour, a minute, a second?

Now, imagine your client buying your financial planning service. How long does your client want to wait before enjoying the benefits of reaching his goals?

Half a century, 25 years, a decade?

In today’s instant-gratification-world, it takes a behavioral shift to move your clients to think about their future.

So, how do you do that?

Yes, it sounds crazy, I know.

You might think it’s about more leads, fees, AUM, or commissions. But no, it’s not.

The real reason is far more interesting. And it’s something most financial planners don’t know.

So before I’ll tell you the truth about how you are able to double your income while having highly satisfied customers, let me first tell you a story.

It has become obvious, in retrospect, that organisations with superb knowledge economy credentials – companies such as Microsoft, General Motors and big Wealth Management Companies, for example –weathered the global economic crisis little better than companies based on the industrial age economics they superseded.

A study done by a pair of Canadian psychologists uncovered something fascinating about people at the racetrack.

Just after placing a bet, they are much more confident of their horse’s chances of winning than they are immediately before laying down that bet.

Of course, nothing about the horse’s chances actually shifts: it’s the same horse, on the same track, in the same field.

But in the minds of those bettors, its prospects improve significantly once that ticket is purchased.

What has this got to do with financial planning?

There are a couple of things I strongly believe in when it comes to the future of financial planning.