“I believe that financial planners will be more successful when using their right brain potential”. Actually it’s strange for me to say. I’ve always been a typical left brainer for years. Good at maths, very rational and successful with study. And always focussing on building knowledge. Because when I finished a study I could say that I achieved something. And that’s very tangible. That’s great, because left-brainers love it when it’s tangible.

I also thought that with this knowledge I could help my clients the most. But after reading Simon Sinek’s book ‘Start with Why’ about three years ago, my perspective changed. The book gave me the urge to search my WHY. And I discovered something I never knew before. Since ‘Start with Why’ I’ve read many, many other business books and found out that almost every successful and innovative influencers (like Seth Godin, Robert Cialdini, Anthony Robbins & Daniel Pink) wrote about the power of the right brain. Since then I can’t stop reading and researching about it. And more important: I’ve applied it in my financial planning profession.

Now, my goal is to inspire other financial planners to believe in their right brain potential. I believe in the importance of the financial planner. Financial planners are by definition highly educated. They have the ambition to reach for the best. And more important: they truly want to help people. Not by selling products. But to give real advice based on what their clients really want. Because financial planners have these strong ambition and are almost always smart people I know financial planners have this right brain potential. When using it right, it’s going to build more profitable and enduring relationships.

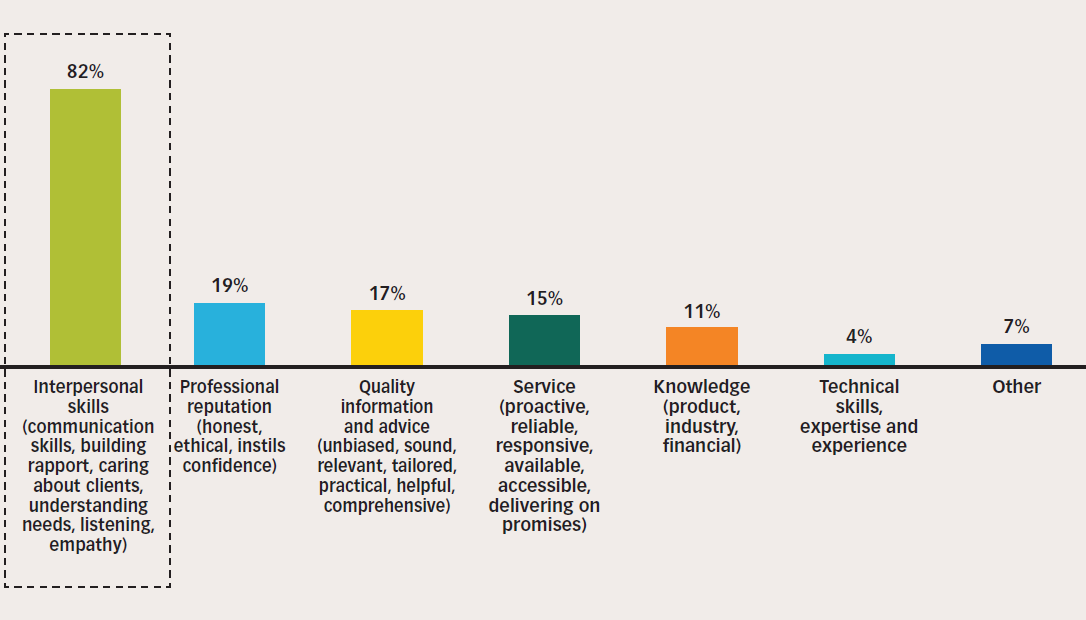

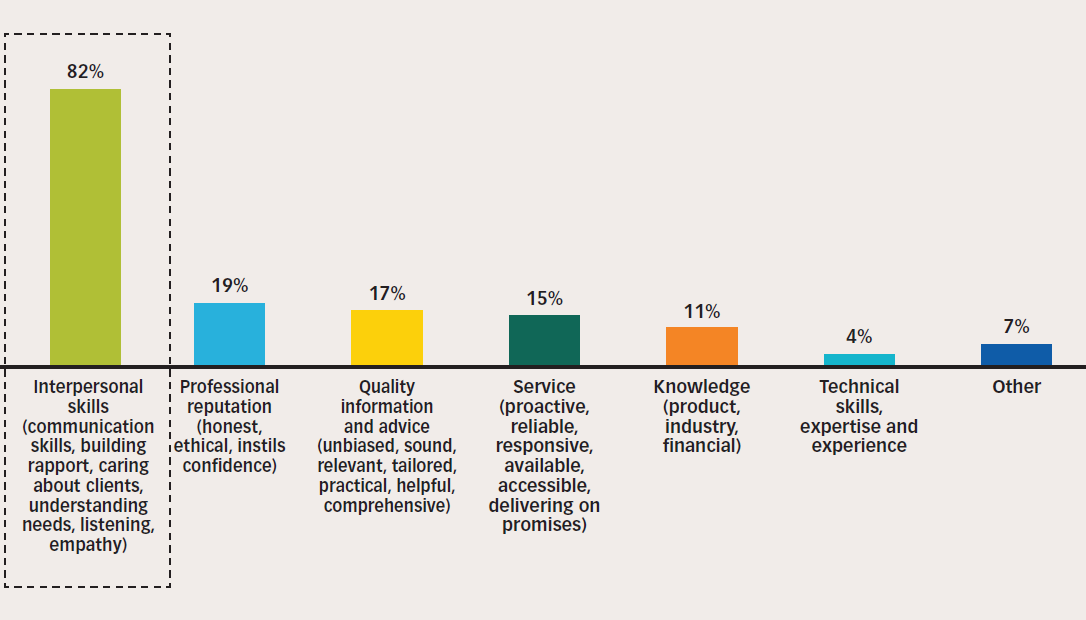

To prove it to you I’m not going to tell you a story, influence you with a metaphor or let you see the big picture. In other words, I’m not appealing to your right brain. To show you that what I believe is true, I’m going to appeal to your left brain in this article. Because I know your left brain asks you to rationalize your choice to work on your right brain potential. And therefore it needs facts and numbers. So please take a look at the picture below.

Continue reading

Here’s a short story that seems to have nothing to do with financial planning (but it does).

Here’s a short story that seems to have nothing to do with financial planning (but it does).

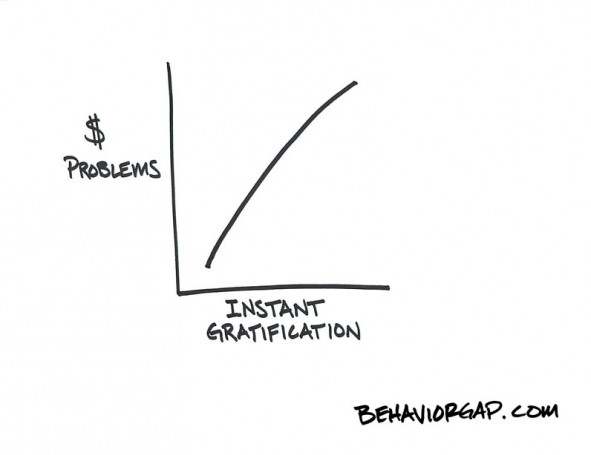

What if you can save at least 60 minutes worth of explanation, reasoning, justification, comparison and analysis in your client interviews? I believe that in the financial planning business there is still a traditional reasoning-centered approach to selling the service. It’s not strange. Most advisors don’t know about the possibilities of right brain selling. I didn’t for 11 years although I continually studied during this period. Are you still using the traditional approach and therefore missing chances to engage, connect and sell more?

What if you can save at least 60 minutes worth of explanation, reasoning, justification, comparison and analysis in your client interviews? I believe that in the financial planning business there is still a traditional reasoning-centered approach to selling the service. It’s not strange. Most advisors don’t know about the possibilities of right brain selling. I didn’t for 11 years although I continually studied during this period. Are you still using the traditional approach and therefore missing chances to engage, connect and sell more?