Why the Compliance Officer Rules and You Will Be the Hero

Remember great epic series like The Game of Thrones, The Tudors or Spartacus. There’s always the bad guy (the king) and the good guy (the hero). Next to the bad guy (the almighty king) is always a personage who is called the king’s counselor. His job is to advice the king about what the king should do to avoid future dangers. You often hear him say things like ‘danger is coming’ or ‘the enemy has gathered’.

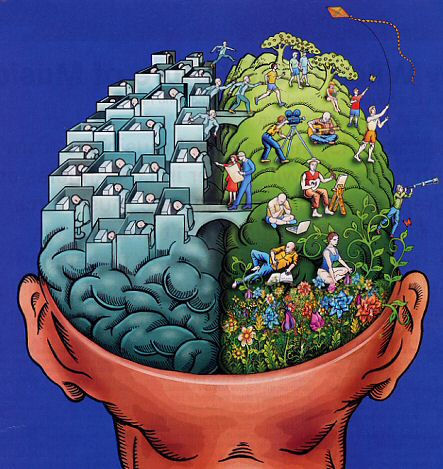

When I was a kid my parents gave me this advice: get good grades, go to college and pursue a profession that delivers a decent living. If you’re good at english and history, you should become a lawyer. And if you are good at numbers, become an accountant. Later I became a financial planner. I guess the numbers had something to do with that. And if I were to be successful in my profession as a financial planner, there was only one thing to do: get my CFP (or in Holland it’s the Master of Science grade). Professor Peter Drucker gave these professions a somewhat wanky name: knowledge workers. “Knowledge workers are people who get paid for putting to work what one learns in school rather than for their physical strength or manual skill”, according to Drucker. Compared to the time when I was a kid and today there has been a major change in the supply of knowledge and information. Which has an underestimated impact on the role of the financial planner.

When I was a kid my parents gave me this advice: get good grades, go to college and pursue a profession that delivers a decent living. If you’re good at english and history, you should become a lawyer. And if you are good at numbers, become an accountant. Later I became a financial planner. I guess the numbers had something to do with that. And if I were to be successful in my profession as a financial planner, there was only one thing to do: get my CFP (or in Holland it’s the Master of Science grade). Professor Peter Drucker gave these professions a somewhat wanky name: knowledge workers. “Knowledge workers are people who get paid for putting to work what one learns in school rather than for their physical strength or manual skill”, according to Drucker. Compared to the time when I was a kid and today there has been a major change in the supply of knowledge and information. Which has an underestimated impact on the role of the financial planner.