181 Here’s What Financial Planners (CFP) Can Learn From Top FBI Hostage Negotiators About Creating Magical Connections In Less Than 45 Minutes

And even create more powerful relationships than many other lifelong friendships.

And even create more powerful relationships than many other lifelong friendships.

Build trust as a Financial Planner

Imagine grabbing a cab.

Picture yourself sitting on the back seat and looking at the taxi meter. Don’t you hate watching the taxi meter going up, knowing that every extra inch of the way is costing you?

Why do you hate this?

It’s because of the pain you are suffering. Not the physical pain of course, but rather an activation of the same brain areas associated with physical pain.

Now, picture your client paying an hourly financial planning fee. Is it any different?

Admit it. You’re skeptical after reading this title.

Admit it. You’re skeptical after reading this title.

Is NOT giving financial advice really the answer to all your prospecting efforts?

You work your ass off on building your knowledge, so will it get the recognition it truly deserves by NOT sharing it with the world?

Well, here’s the disappointing truth…

It’s practically a financial planning commandment.

Thou shalt obey the compliance officer.

And even if those words have never been etched into stone, it’s still rock-solid advice. After all, if you DON’T follow their advice, your financial planning career will be doomed. Forever.

Knowing this, you take compliance seriously.

You read what they publish.

You study for their exams.

You tweak every process until it’s perfect.

But does this help you? I mean, does this help you to move forward?

If you’re honest, you can’t help but feel mortified at the prospect of staying hopelessly trapped in the compliance officer’s rules.

You want to break out. You want to escape. You want to do it your way.

Imagine that your prospects didn’t hesitate, not even for one second, to pay your price. That it would be – in fact – a no-brainer.

Don’t believe that’s possible? Then stop here.

However, if you don’t want to leave money on the table and if you don’t want to miss my free gift at the end of this article, you might want to keep reading.

In my previous article I asked you why you think your clients don’t refer your financial planning service. And more than 100 planners gave me a worthy answer.

However, I wonder if those planners have ever thought of this:

You probably aren’t aware of this. But it’s true: financial planners are heroes.

Imagine your client-to-be comes to you and says:

“I see you are the perfect financial planner for me because of your professional designation. So therefore, I would really like to work with you”

If you have experienced this, then stop reading this article.

Otherwise, you might want to continue.

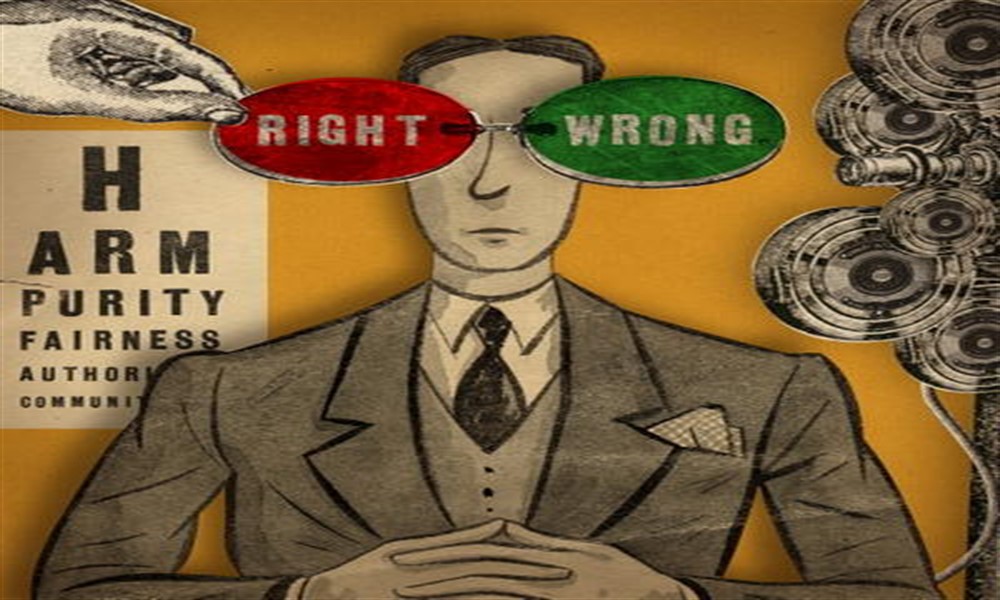

Good financial planners, we’ve long been told, are skilled problem solvers. They can assess people’s needs, analyze their predicaments, and deliver the optimal solution.

But today, when information is ubiquitous, the ability to solving problems matters relatively less.

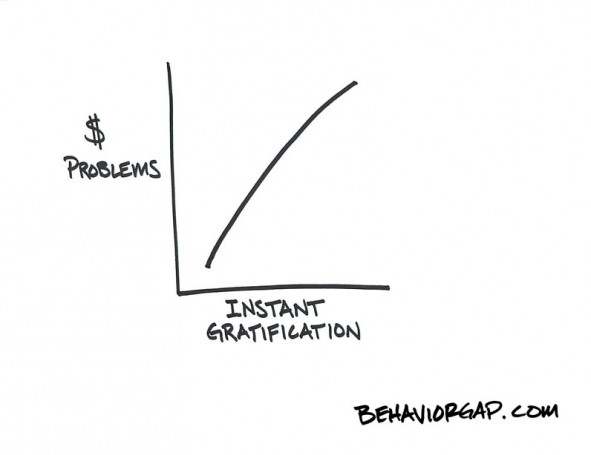

Imagine yourself buying something from the internet. How long do you want to wait before enjoying your purchase?

A day, an hour, a minute, a second?

Now, imagine your client buying your financial planning service. How long does your client want to wait before enjoying the benefits of reaching his goals?

Half a century, 25 years, a decade?

In today’s instant-gratification-world, it takes a behavioral shift to move your clients to think about their future.

So, how do you do that?