It’s practically a financial planning commandment.

Thou shalt obey the compliance officer.

And even if those words have never been etched into stone, it’s still rock-solid advice. After all, if you DON’T follow their advice, your financial planning career will be doomed. Forever.

Knowing this, you take compliance seriously.

You read what they publish.

You study for their exams.

You tweak every process until it’s perfect.

But does this help you? I mean, does this help you to move forward?

If you’re honest, you can’t help but feel mortified at the prospect of staying hopelessly trapped in the compliance officer’s rules.

You want to break out. You want to escape. You want to do it your way.

And that may feel like a tough thing to do. However:

Outsmarting the Rule-makers Isn’t That Difficult.

And no, I’m not talking about disobeying the rules. That would be dumb.

What I’m referring to, is outsmarting them by being bold – in the non-compliance-zone.

How?

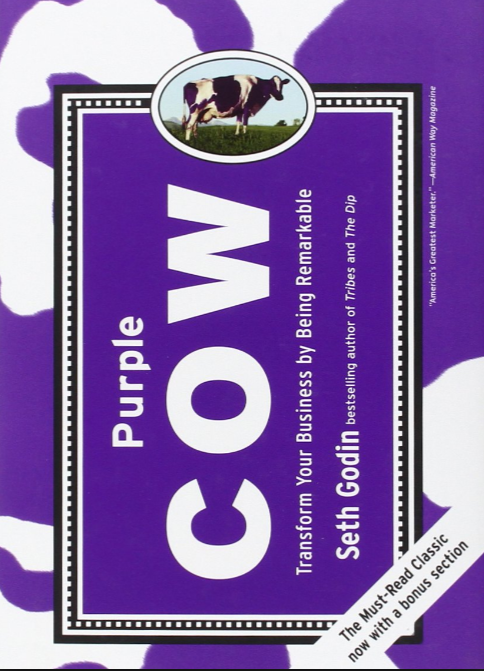

Just follow brilliant advice from the book Purple Cow – Transform Your Business By Being Remarkable, written by the legendary marketing-genius Seth Godin.

Here’s Purple Cow in one sentence:

In a crowded marketplace, fitting in is a failure. In your career, being safe is risky. The path to lifetime job security is to be remarkable.

Godin says that you won’t get noticed if you don’t give your customers something worth talking about.

Something which evokes an emotion worth talking about.

Something they want to call their friends for.

The only problem?

Most financial planners don’t know how to be bold and remarkable.

Being Bold is Scary. Here’s why.

Do you think that people consider the financial services industry “remarkable” in the positive sense of the word?

I’m pretty sure most people don’t.

Why?

Because most financial planners seem to do what we’ve always done, sell what we’ve always sold and deliver services like we’ve always delivered.

And that’s the problem.

The old rule was: create safe, ordinary services and combine it with great marketing.

The new rule is: create remarkable services that the right people seek out.

Unfortunately we don’t act on this new rule. Instead, we tend to use poor excuses:

Deniability–“The rule-makers decided I should do x, y, z. Not my fault.”

Helplessness–“The compliance officer won’t let me.”

Contempt–“They don’t pay me enough to put up with the likes of these customers.”

Fear–“It’s good enough, it’s not worth the risk, people will talk, this might not work…”

Our past brought us compliance. Compliance brought us fear. And fear has the annoying effect that we tend to do the same of what worked in the past.

But doing the same brings us mediocrity. And mediocrity won’t work in the new age, with it’s new rules, new marketing and new economy.

It’s not the path to success.

But hey, we are financial planners. We plan the future. It would be odd if we didn’t have a plan to prepare ourselves for the changing future.

You see, the new age brings huges opportunities for success. And yes, being remarkable is just one of those opportunities.

While just about every planner is petrified of “being remarkable”, you become remarkable with even less effort. If successful new financial planning services are the ones that stand out, and most planners desire not to stand out, you’re set!

How To Be Bold by Being Unruly

Here’s the secret right off the bat:

Have a worldview/point of view that sets you apart from your competition.

Make it bold, and make it something people can disagree with.

Why is this important?

First, you don’t want to please everyone because that would make your service ‘bland’.

Second, it’s easier for new customers to make an emotional connection with your service when it has a bold opinion. When this opinion aligns with their own (values), it instantly creates a connection. For example, think about Apple.

- Customer research among millennials shows that 64 percent of consumers with a brand relationship say that shared values are the reason why they’ve engaged with a brand.

- Also, 87 percent of millennials say they appreciate it when companies make it clear what values they stand for, and

- 81 percent say companies that invest in their communities deserve loyalty.

Here’s more info on the millennial connection, from a SlideShare from The Futures Company:

How to Use Strong Opinions to Grow Your Service

1. Find your opinion. Ask yourself the following questions: What is it that you stand for that not all financial advisors (competitors, clients, prospects) agree with? What are the things that you would love to change? What irritates you the most?

2. Communicate your opinion as often as possible. People must recognize your service for this worldview, so make sure they read it on your website and in as many emails as possible.

3. Show your worldview in every client touchpoint. Your clients should recognize your worldview not only in words, but mainly in action. Create this in every interaction, be it sales, marketing, delivery of your financial plan, or aftersales.

4. Find stories and share those. If you want people to talk about your financial planning service, you should give them stories. The best way to do this is to communicate stories of your own clients – on how they use your service in line with your worldview.

And I hear you think, gimme some examples.

How to Be Bold – 3 Powerful Examples

Don’t change the worldview of your clients and prospects about what they “should” believe about your service. Instead, identify your target audience with a worldview that aligns with theirs, and frame your message in terms of that worldview.

Why does this work?

Because people are already engaged with you, even before you know them.

For example: if your client’s worldview is about protecting himself or his family, that client will respond extremely well to a financial planning service that’s framed in terms of that client’s fear.

That’s why you might want to use one of the following examples of client-wordviews:

Client worldview #1: “I don’t trust online financial services”

Bold Opinion #1: We don’t specialize in tech, we specialize in people.

Client worldview #2: “Protecting my family from harm is the most important thing I can do”

Bold Opinion #2: Protecting your money from disaster is what we do, protecting your family from harm is why we do it.

Client worldview #3: “Don’t tell me shallow stories, talk to me about inner values, quality and life”

Bold Opinion #3: You probably know how much money you have. You probably don’t know how much it’s worth.

Are You Ready to be Bold?

The reason most financial planners fail to be remarkable, isn’t a lack of talent or smarts or technical know-how.

It’s about having a service that doesn’t stand for anything, so they end up being everything to everyone.

But you’re going to be different, right?

You’re going to commit yourself to being remarkable, right?

You’d better.

If not, the compliance officer wins.

Imagine that …

Let’s make financial planning matter,

-Ronald