Why Money Can’t Buy You Like

As Lennon and McCartney wrote a half century ago, money can’t buy you love. But in today’s world, where people have come desensitized by ad campaigns and marketing slogans , that maxim needs an update: money can’t even buy you like.

That’s because we’ve entered the ‘Relationship Age’ where the only path for financial planners seeking long-term success is to create authentic customer relationships. Not through old traditional marketing. Old traditional marketing is: interrupting your clients with whatever they are doing. You are disturbing your clients by shoving them your marketing message under his nose.

Before I’ll tell you how te create authentic relationships with new marketing, let me tell you why I think we are entering ‘the Relationship Age’. Here are 4 reasons:

Many financial planners are at risk. They think that they fullfill the needs of their clients by showing the numbers of their financial plan. “The figures should be perfect. It’s in my clients best interest that he sees this”. The numbers are often a priority of the financial planner. Mostly outof compliance-considerations. But also because the planner thinks he’ll persuade his client with those numbers.

Many financial planners are at risk. They think that they fullfill the needs of their clients by showing the numbers of their financial plan. “The figures should be perfect. It’s in my clients best interest that he sees this”. The numbers are often a priority of the financial planner. Mostly outof compliance-considerations. But also because the planner thinks he’ll persuade his client with those numbers. Most people hire a financial planner because they have a problem. A problem that you have to solve for them. Many financial planners think that their client only wantw their advice. But your clients also have another problem. If you ignore that problem you’re missing a huge opportunity. Chances are that you don’t take this into account. You should. Because you can miss sales if you don’t.

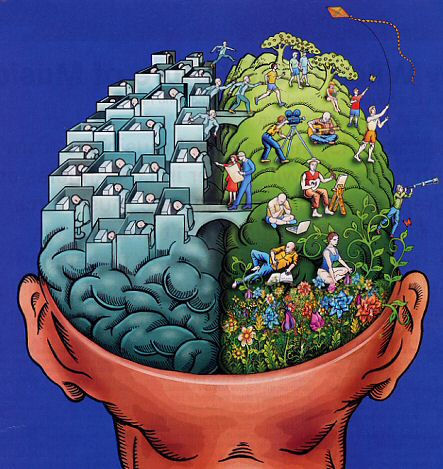

Most people hire a financial planner because they have a problem. A problem that you have to solve for them. Many financial planners think that their client only wantw their advice. But your clients also have another problem. If you ignore that problem you’re missing a huge opportunity. Chances are that you don’t take this into account. You should. Because you can miss sales if you don’t. When I was a kid my parents gave me this advice: get good grades, go to college and pursue a profession that delivers a decent living. If you’re good at english and history, you should become a lawyer. And if you are good at numbers, become an accountant. Later I became a financial planner. I guess the numbers had something to do with that. And if I were to be successful in my profession as a financial planner, there was only one thing to do: get my CFP (or in Holland it’s the Master of Science grade). Professor Peter Drucker gave these professions a somewhat wanky name: knowledge workers. “Knowledge workers are people who get paid for putting to work what one learns in school rather than for their physical strength or manual skill”, according to Drucker. Compared to the time when I was a kid and today there has been a major change in the supply of knowledge and information. Which has an underestimated impact on the role of the financial planner.

When I was a kid my parents gave me this advice: get good grades, go to college and pursue a profession that delivers a decent living. If you’re good at english and history, you should become a lawyer. And if you are good at numbers, become an accountant. Later I became a financial planner. I guess the numbers had something to do with that. And if I were to be successful in my profession as a financial planner, there was only one thing to do: get my CFP (or in Holland it’s the Master of Science grade). Professor Peter Drucker gave these professions a somewhat wanky name: knowledge workers. “Knowledge workers are people who get paid for putting to work what one learns in school rather than for their physical strength or manual skill”, according to Drucker. Compared to the time when I was a kid and today there has been a major change in the supply of knowledge and information. Which has an underestimated impact on the role of the financial planner.  When you’ve ever followed a training on your interview skills, one of the most heard techniques is that you should use open-end questions that encourage more than one-word answers. This gives people an opportunity to further explain themselves and adds color and texture to their personal story. And that gives you the opportunity to ask depth questions to come to know more of the goals of your client. Which is the basis of your financial plan. There’s just one problem you may encouter. When people meet you for the first time, they are mostly not eager to tell you their whole story. Why? They don’t trust you yet.

When you’ve ever followed a training on your interview skills, one of the most heard techniques is that you should use open-end questions that encourage more than one-word answers. This gives people an opportunity to further explain themselves and adds color and texture to their personal story. And that gives you the opportunity to ask depth questions to come to know more of the goals of your client. Which is the basis of your financial plan. There’s just one problem you may encouter. When people meet you for the first time, they are mostly not eager to tell you their whole story. Why? They don’t trust you yet.