3 Financial Planning Is Heading Towards It’s Spotify Moment

What if financial planning could be done fully digital? No planner needed.

Is this the scenario we are heading towards?

What if financial planning could be done fully digital? No planner needed.

Is this the scenario we are heading towards?

What is professionalism?

Professionalism is fitting in.

Fitting in the corporate culture of targets, AUM and commissions. Fitting in the accepted belief that more is better. Fitting in to not challenge the status quo in the financial services industry.

Imagine that Steve Jobs was a professional. Would there be an iPhone?

There are three types of financial planning businesses.

All three have its own style, it’s own structures and measurements and it’s own strategies.

The question is: are you in the type of financial planning business you really want to be in?

Sir Edmund Hillary and Sherpa Tenzing Norgay

Do you believe that your clients act on your financial plan?

Then imagine Sir Edmund Hillary, the first man to climb Mount Everest, explaining how he was able to accomplish that feat.

Suppose he had explained he was just walking around one day when he happened to find himself at the top of the tallest mountain in the world.

Ridiculous of course. But no more ridiculous than your thinking that your client will stick to your financial plan while you are not working to make it happen.

Why consider to serve another niche?

There are a million and one financial planners, advisors, wealth managers or online solutions on the market. The market is so saturated, so why bother launching yet another one?

Before answering this question, let’s go back in time. Where we lived in a world with limited choices and big companies could afford to cast the net wide across the masses. No depth required.

Do you think this tactic works now that the masses have the power to choose? Where people have the choice to visit your competitor with two swipes? The market of everyone has disappeared and that’s scary for big companies.

Some things are so common, that you think it’s true without even thinking it might not be. The Beatles sang “Money Can’t Buy Me Love”. And that’s true, probably.

Everybody says “Money Can’t Buy Happiness”. And that’s true, probably.

But what if there is scientifical evidence that money CAN buy you happiness?

Before I’ll tell you what a PSNIOR is, I’d like to tell you a short story about a flea trainer. Because a financial planner can be as successful as a flea trainer. Successful as in meaningful, happy and satisfied. I’m serious.

Do you want to know how to train fleas?

There’s a myth about the success of setting goals.

The myth says that back in 1953, Harvard University conducted a study on the graduating class. They discovered that only 3% of the graduating seniors had definite predetermined objectives.

Twenty years later they did another survey of those same people, and of the 3% that had set those goals and committed them to paper and had made a commitment, they had accomplished more in their lives than the 97% who had not written it down.

However, there seems to be evidence that this myth isn’t true.

Now, you can call me pigheaded, but I strongly believe that this myth most certainly is true. Here’s why:

Marco van Basten

When I think of people who made the biggest impact in my life, it was not their expertise or their accomplishments that provided me with direction, guidance and reassurance I needed to accomplish my goals.

It was their sincere belief in me. They let me know through their words and actions that I mattered.

Your clients want that same validation.

In fact every single person you meet, shares this common desire. As I wrote last week, the largest part of a financial planner’s target audience want to know they matter. Mattering is a universal human need. And it’s one you have the opportunity to satisfy.

But it’s not only the people who believed in me which had an impact in my life.

There’s one other person who totally influenced me. He didn’t believe in me. Actually, he doesn’t know me.

But although he doesn’t know me he still means the world to me. He mattered to me in the past and he matters to me now. No matter what he does or doesn’t do, I believe in him.

This person is Marco. Marco van Basten.

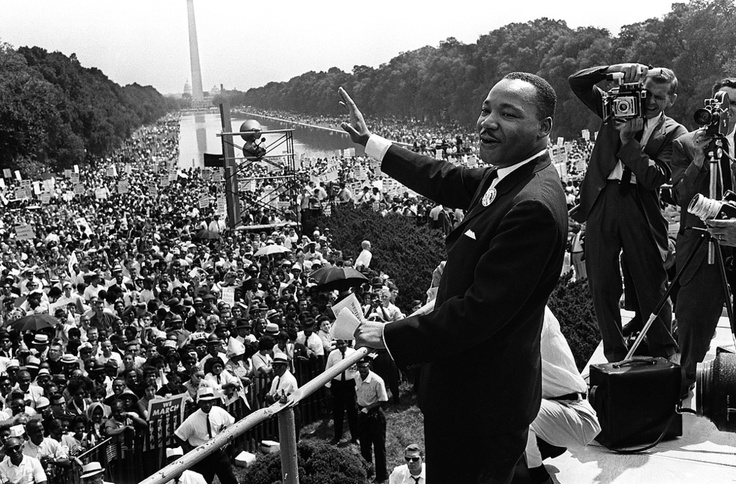

Raving fans for the financial planner

Not a single financial planner wants to scare his potential clients off when telling the story about their business. Yet, very few financial planners dare to really attract their clients with the real reason they are in business. But what if that reason is a story that makes you more believable, trustworthy and gets you more clients (and maybe even some raving fans)?