You’re smart, motivated, and hard working. So you figure you have everything it takes to help people. Right?

Well, not quite.

To explain why, let’s do a little quiz. Let’s see how you do:

- Name the five wealthiest people in the world

- Name the last five winners of the Miss Universe contest

- Name ten people who have won the Nobel or Pulitzer Prize

- Name the last half dozen Academy Award winners for best actor and actresses

The point: These are not second-rate achievers. They are the best in their fields. Still, none of us remember these statistics. Why? Because the applause dies. Awards tarnish. Achievements are forgotten. Accolades and certificates are buried with their owners.

Here’s another quiz. See how you do on this one:

- Name three friends who have helped you through a difficult time

- Name three people who have taught you something worthwhile

- Think of three people who have made you feel appreciated and special

- Think of three people you enjoy spending time with

Much easier, right?

Here’s the lesson:

The people who make a difference in your life are not the ones with the most credentials, the most money or the most awards. They are the ones who care.

So, let me ask you this:

“Do you care about your clients?”

You answered this question with “yes”, didn’t you?

So, if you care about your clients, how do you think you can help your clients most?

If you’re like most planners, you’ll say something like: “I help my clients most by making sure they are reaching their financial goals”.

The only problem?

You aren’t sure if that’s what your clients really care about.

Because while many expert planners preach the virtues of “goal-based-planning”, almost nobody tells you that 97% of your customers don’t even have financial goals.

As a result, many well-intentioned planners believe they are helping their clients by spending their precious time and money on what they think their clients care about.

In reality?

They fail miserably.

Why Most Financial Planners Are Terrible Helpers

First some good news: it’s not your fault.

Let me explain by telling you a little story about the human mind (and why you believe you are helping your clients)

Because conventional wisdom says that our brain has two independent systems at work at all times. Plato said that in our heads we have a rational charioteer who has to rein in an unruly horse that “barely yields to horsewhip and goad combined.”

Freud wrote about the selfish id and the conscientious superego. More recently, behavioral economists dubbed the two systems the Planner and the Doer.

And I, Ronald Sier, financial planner (and not even an amateur-psychologist), likes to call it left- and right brain. The left-brain is the rational, reflective, conscious side. It’s the part that deliberates and analyzes and looks into the future. While the right-brain is instinctive and emotional, always looking for instant gratification.

However, the best analogy that captures our left-and right-brain is laid out in Dan and Chip Heath’s bestseller Switch: How to Change Things When Change Is Hard:

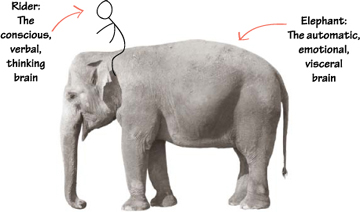

“Imagine an Elephant. And on top of the Elephant sits a Rider. The Rider and the Elephant are like the human mind. Our rational left-brain is the Rider and our emotional right-brain is the Elephant. Perched atop the Elephant, the Rider holds the reins and seems to be the leader.

However, the Rider’s control is precarious because the Rider is so small relative to the Elephant. Anytime the six-ton Elephant and the Rider disagree about which direction to go, the Rider is going to lose. He’s completely overmatched.

Most of us are all too familiar in which our own Elephants overpower our Rider. You have experienced it if you’ve ever slept in, overeaten, dialed up your ex at midnight, procrastinated, tried to quit smoking and failed, or skipped the gym.

You also experienced it with your clients. You’ve experienced it when they didn’t follow up on your advice, procrastinated, wanted to buy stocks when prices are high, not saving for retirement and so on.

In those situations, it’s the weakness of the Elephant that overpowers the Rider. It’s the emotional and instinctive side that takes control and ignores the Rider.”

Still, financial planners like to think, that when it comes to helping people, our job is to analyze, to plan for the future, to be rational. In other words, we believe our job is to appeal to people’s Rider.

And then we leave it at that (which is terrible for truly helping people).

But what about the Elephant?

Because the truth is that the Rider simply can’t keep the Elephant on the road long enough to reach the destination.

In other words: the financial planner simply can’t keep his client engaged long enough to help reach their financial goals. Because the Elephant’s hunger for instant gratification outweighs the Rider’s strength, which is the ability to think long-term, to plan, to analyze.

But here’s a surprise: although the Elephant’s hunger for instant gratification is a problem, the Elephant also has enormous strengths.

The Elephant isn’t always the bad guy. Emotion is the Elephant’s turf – love and compassion. Sympathy and loyalty. That fierce instinct you have to protect your kids against harm – that’s the Elephant.

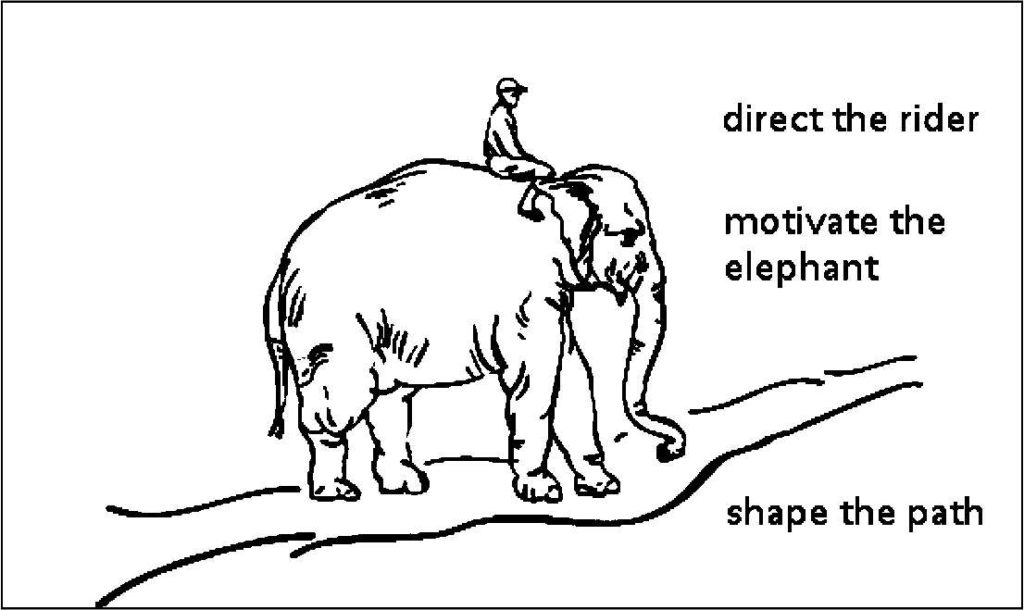

While the Rider tends to overanalyze and overthink things, it’s the Elephant who gets things done. If you want to help people to make progress toward their financial goals, it requires the energy and drive of the Elephant. While you help your client’s Rider by giving them planning and direction, you also need to engage their Elephant to provide the energy.

If you really want to help people, you’ve got to appeal to the Rider AND the Elephant

when you reach your client’s Rider but not the Elephant, your clients will have understanding without motivation, compassion or emotion. If you reach their Elephants but not their Riders, they’ll have passion without direction.

And while you are very good at engaging with your client’s Rider, most planners still need to use their right-brain to engage with their client’s Elephant.

How to Motivate the Elephant

In the 1980s, a major study of corporate change efforts found that financial goals inspired successful change less effectively than more emotional goals did. One manager at a glass company suggested, “it’s hard to get excited about 15% return on equity”.

Yet, many financial planners believe that people are motivated by helping them to reach their financial goals. In looking for a goal that reaches the Elephant – that hits your clients in the gut – you can’t bank on financial goals.

It’s like climbing Mount Everest. Most mountain climbers’ goal is to reach the top. But what really satisfies them is the enjoyment and the challenge.

That’s why you need to remember this:

Financial goals presume the emotion; they don’t generate it

And I hear you think: “What does?”

In “The Heart of Change” John Kotter and Dan Cohen say that most people think change happens in this order: ANALYZE – THINK – CHANGE. And I believe most financial planners think it works this way too.

Financial planners analyze – your clients think – and then they change.

And this works pretty well when parameters are known, and the future is not fuzzy.

But most of our clients’ situations don’t look like that, especially not with entrepreneurs. In most of their situations, their future is quite fuzzy.

And because of that uncertainty, the Elephant is reluctant to move, and analytical arguments will not overcome that reluctance. (If someone is unsure about whether to marry her significant other, you’re not going to tip her by talking up tax advantages and rent savings).

Kotter and Cohen observed that, to motivate people, the sequence is not ANALYZE – THINK – CHANGE, but rather SEE – FEEL – CHANGE.

You have to present your clients with some evidence that makes them feel something. It might be a disturbing look at the problem or a hopeful glimpse of the solution. It has to be something that hits them at the emotional level. And It has to be something that speaks to the Elephant.

But which feeling?

Here’s the answer: A positive feeling.

Something like hope, happiness, enthusiasm, pride, love, joy.

Why? Because it turns out that – while negative emotions tend to have a “narrowing” effect on our thoughts, positive emotions are designed to broaden and build people’s repertoire of thoughts and actions. Joy, for example, makes people want to play. Play doesn’t have a script, it broadens the kinds of things we consider doing. And because joy encourages us to play, we are building resources and skills.

In other words, people will be open to new ideas.

Think about it. The positive emotion of pride, for example, experienced when we achieve a personal goal, broadens the kinds of tasks we contemplate for the future, encouraging us to pursue even bigger goals.

So, why don’t you start motivating your clients to reach their financial goals?

Wouldn’t that be the ultimate satisfaction as a helpful financial planner?

There are several options. You might want to experiment by asking different kinds of questions to each and every client. But that can take a lot of time to figure out.

But if you want to use a proven worksheet that – regardless of the type of clients your serve – works to motivate them to reach their goals and to follow up on your advice, I have something for you. And it’s FREE.

If you truly want to help your clients, the only thing you have to do is to answer the following question:

What motivates YOU to be a financial planner?

Please, answer this question by leaving your comment – here below – and you’ll receive a free PDF with The Cheat Sheet to Motivate People to Follow Up on Your Advice Right Now.

Thank you for your comment.

Let’s make financial planning matter.

Ronald Sier