What if financial planning could be done fully digital? No planner needed.

Is this the scenario we are heading towards?

In an intriguing and very readable financial times-article is argued that the financial services industry – and especially banking – is very ‘digitizable’. For banks, actually cash is the only part that is inherently physical. And that is only a tiny part of what a bank does.

It will happen and when it does, it will have a huge impact, the article says. Some of the consequences are clear from other industries. Intermediaries disappear or get marginalized unless they discover new ways of adding value.

“Banks are the primary intermediaries of the financial world, so their margins will fall unless they reinvent what they offer their customers and how they work. The financial services industry must embrace technology-driven-innovation. Otherwise, it will simply happen by stealth, driven by players outside the industry”

The digitalization in our industry is growing. Fast. And yes, there are already new initiatives which make a financial planner seem like an obsolete and expensive version compared to the innovative and new generation financial planning services.

The question is: is this going to eradicate our profession?

An irrational story about the music industry

Although Spotify, iTunes and other free music services are growing rapidly for the masses, there’s another seemingly disappeared market who’s rising from the dead.

It’s the vinyl records market.

This analog format made of polyvinyl chloride has been the main vehicle for the commercial distribution of pop music from the 1950s until the 1980s when they were replaced by the cassette tape and compact disc.

Since the early 2000s sales of vinyl records have been largely replaced by digital downloads. Strange enough, it is at this point that the downward trend for sales in vinyl was reversed and in some territories, vinyl is now even more popular that it has been since the late 1980s.

Since 2006 the renewed interest in vinyl records is even called a ‘vinyl revival’ by Wikipedia. The term is not just used to describe sales and commercial activity, however. Since the mid-2000s there has also been renewed interest in the record shop, the creation of the annual worldwide record store day, the implementation of music charts dedicated solely to vinyl, and an increased output of films (largely independent), and television or radio programmes dedicated to the vinyl record and culture.

It turns out that in the period 2007-2012 vinyl sales have increased by 211%. And sales have even gone up by a third in the first half of 2013.

Now, here’s a very irrational thing going on.

While you have access to free, unlimited, pocket-portable music (and within a short time even wrist-portable music), people buy a 12 inch analogue sound storage medium which only can be listened to when using a huge old-fashioned record player.

How come?

As it turns out people look elsewhere to find a format that allows for a fuller listening experience. The analog sounds of vinyl are still considered to be superior to all other formats of music.

Do you understand now that even ‘new generation artists’ such as Radiohead are supplying the market with fresh new vinyl material?

As Billy Gibbons, the ZZ-top frontman quotes:

That tactile feel of flipping through a stack of vinyl remains one of life’s simple pleasures

The Spotify moment is coming soon

While reading this story about vinyl records, you might think that I draw parallels with the financial services industry.

I do.

But I do not suggest that the old days were better in the financial services industry.

On the contrary. Too much went wrong.

What I do suggest is that financial planners have no choice than to embrace the digital revolution in our industry. The digitalization of our market is unstoppable and will have a huge impact. Just like it had to the vinyl records marketplace.

Therefore it’s time that financial planners acknowledge that we have left the information age where we could distinguish ourselves with our knowledge. Because knowledge and information are already everywhere and only a couple of swipes away.

And if that’s not your problem, then the new initiatives in the marketplace may be. Innovation will come, which can make you seem obsolete.

This means that also the financial planning profession will reach it’s Spotify moment where free-and-easy-to-use-online-services will rule the marketplace.

And will be a huge threat to your ‘vinyl’ services.

Can you compete with free, easy, and online?

There’s only one way according to Seth Godin.

Seth says: “Sell something better than free”.

Provide a service that’s worth paying for. You don’t need a better tactic, such as a way to talk about what you do, a better gimmick, or a better social media strategy.

What you need is to reinvent and rebuild what you make for a new reality. A reality where paying for something is an intentional act of buying something way better than the free alternative.

This may seem obvious. But I’m sure it’s not obvious for most financial planners who try to sell the old thing in a new market.

We don’t want to be wiped out, just as the vinyl records market did, before reviving.

So what we can learn from the vinyl records market is that the experience is the holy grail. The experience of listening is far more exclusive and superior than the all the other digital options.

Somebody was trying to tell me that cd’s are better than vinyl because they don’t have any surface noise. I said, listen mate, life has surface noise ~ John Peel

The experience is what makes people feel……..something.

As vinyl delivers not only the superior sound but also the fullest listening experience in the music industry, I believe the financial planner delivers the superior advice in the financial services industry.

But what about the experience and ’the tactile feel’ the financial planner is selling?

What do you do to make your client feel……something?

What Spotify doesn’t deliver and you do

Ask your client this:

What do you want to experience using another kind of financial planning service than the free, easy, and online version?

“Nothing. What possibly can be better?”, is what the logical and rational left-brain might answer.

“A feeling of ………….”, is what the emotional and high touch right brain might answer.

So focus on your client’s right brain.

Tell stories. Ask the right questions. Use empathy, not sympathy. Deliver superior work.

We can learn from the vinyl records industry by considering this 3-step approach:

1. Choose the right niche

The vinyl records market is a niche in the music industry. A niche for people who love the quality, the experiencing, the sense of belonging and maybe a bit of nostalgia when listening to vinyl records.

It’s certainly not for the masses.

There are people who love vinyl. How do you make your client love your service?

You have to make them feel……..something. Do you make them feel excited, important, meaningful, relieved, respected, in control, or even a sense of belonging to something bigger than themselves??

If you have chosen, adjust your service by doing everything to make your client feel <……..>.

After all, there’s only one thing your clients care about the most: themselves.

2. Build a community

Don’t serve everyone. Only the people who eagerly want to join you.

Join you, because you remember them how they want to feel. And that’s a rare service in times of digital revolution.

I’m not sure there’s any number of Facebook likes that can replace a hug ~ Seth Godin

The people in your community say: “people like us come to a place like this.”

3. Enrich peoples lives

Through choosing to enrich other people’s lives, you add meaning to both their lives and your own.

Here are some simple steps to follow:

- Commit: Commit to lifetime-relationships that span events, companies, causes and geographic boundaries

- Care: Care for the concerns of others as if they are your own

- Connect: Aim to connect those who will benefit and enrich each other’s lives in equal measure

- Communicate: Communicate candidly. Tell people what they should hear rather than what they want to hear

- Expand Capacity: Aim to expand people’s capacity to help them give and get more from their own lives

If you are truly enriching someone’s life, they will typically miss you in their past. They think their lives would have been even better if they had met you earlier. You are only as rich as the enrichment you bring to the world around you.

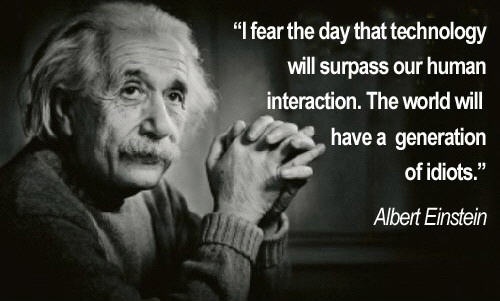

Remember the quote from Albert Einstein at the top of this page.

So don’t let Albert down.

Don’t let technology and digitalization make you seem obsolete.

Act.

Now.

How are you going to enrich people’s lives?

Please, leave your answer here below in the comment field. Thank you very much.

Let’s make financial planning matter.

Ronald Sier