This Is Why Free Prospect Meetings Mostly Don’t Work (and What Will Instead)

I get it.

You don’t want to be one of the thousands of financial planners stuck in the land of sameness — indistinguishable as you parrot the same old advice everybody else does.

You want your service to get noticed, and you want it to feel vibrant, fresh and new.

But your financial planning service might feel threadbare, and you’ve got no bloody idea how to make it exciting again.

So you search for answers on how to stand out.

But all you find is this airy-fairy platitude: Offer a free first prospect-meeting!

Which feels like surface-level hoopla that lacks the substance and specifics you really need.

The harsh truth?

No-one wants your free first appointment.

And if you genuinely don’t agree, go create a facebook advert offering “free first appointment with a financial planner”.

Let me know the results …

I’m comfortable though betting free first appointments aren’t scaling anyone’s lead generation.

But there’s a bigger issue.

Because research from Australia suggests this:

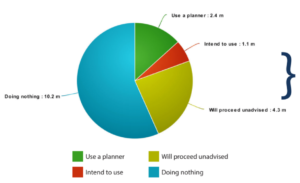

This is an excerpt from the 2017 Investment Trends report. And according to this report, over 50% of advice leads never make it past the first appointment.

50%!

As in they are so unimpressed by their initial experience, they don’t come back.

So …

If less than 15% is getting advice, and only 6% of the rest are seeking it, AND over 50% of the newbies are so unimpressed by the experience they don’t come back, is this something we might need help with?

How to Solve the First Appointment Problem: Cheese & Whiskers

As it turns out, most financial planners have two problems:

- The marketing problem; why most people aren’t interested in financial planning.

- The experience problem; the reason the experience isn’t (statistically) converting leads into advice advocates any better than a coin toss.

The reason is best explained by a wise business coach from the US called Dean Jackson.

He calls the problem: Cheese and Whiskers.

“Prospects”, according to Dean, “are like mice.”

“Mice want two things in life; free cheese and to avoid cats.”

In the human context, cheese is all the awesome stuff. Happiness. Freedom. Wealth. Security. The best for ourselves, our friends and our families.

Cats are the bad stuff. Hardship. Suffering. Sacrifice. Being tricked into paying for things we later realize it didn’t add value. Being faced with the real truth about our situation. Having to make choices.

What most financial planners don’t realize is; we’re cats.

So, when you offer your amazing “Free First Appointment To Get Clear On Your Lifetime Goals”, you want to know what most prospects hear?

“How about a meeting with a cat, yeah?”

To get people in a room with you, you need to offer something of value.

Something they value.

The foundation of delivering this value lies in understanding that, in most cases, your prospect and you have very different goals from this process:

- You want a meeting with a potential client.

>> They want information.

- You’re eager to add value.

>> They’re wary of what strings this “value” is attached to.

- You need to gather data.

>> They would rather just get a solution.

- You want to create rapport, start to build a relationship and educate them about what they need.

>> They probably have enough friends, but do need a problem solved (and it isn’t “get holistic advice”).

Are You a Financial Planner? Do You Want to Know Why People Don't Buy Financial Planning?

If you want to boost your financial planning skills, you don't want to miss this free email course. Just fill in your best email here below, and you'll receive the first lesson right into your inbox.

Play The Long Game

Most advice firms play far too short a game, particularly when it comes to the online world.

It’s like watching some besuited Wall Street type bowl into a nightclub, attempt to take home six “targets” in minutes and wonder why they’re going home early courtesy of the bouncer.

If you want to create a consistent stream of prospects who know who you are, know what you do and now want to talk about what you can do for them, stop offering free first appointments.

Start offering free cheese:

- Some ideas on how to get a foot into the property market.

- A simple “bucket” system for saving more money.

- A plan to set their kids up for life and some guidelines on the cost of private education.

- A means of saving more tax.

- An example of a before and after investment strategy that will halve the fees paid.

- A detailed breakdown of living costs in retirement to complement the ABS data.

- An hour and a half of your time to ask anything they want about the topic of their choice.

- A downloadable guide on how to save 20% of their income without feeling like they’re sacrificing anything.

- A simple checklist template for finding out whether their current adviser is actually looking after them.

- A simple questionnaire that will give them a Wealth Fitness score out of 200 compared to other Australians.

- A letter template to send to their fund so they can get a straight answer about how their money is being managed (or mismanaged)

- A case study of three people who went from no plan, to retired and traveling the world in five years, including details of what their trips cost item-by-item.

- Clarity around where they are at and what they need to think about how to get what they want, without any jargon or salesmanship.

The Appointment 2.0

They initially have a demand for information.

Fulfil that demand, without strings or catches.

That will lead to demand for more if you do it consistently.

Which ultimately, if you decide they’re the right fit, leads to an appointment.

And, when you get to the appointment stage, this is going to change too.

- You’re only going to meet with those you can best help. “Anyone with a heartbeat” is no longer a growth strategy.

- You’re going to add value before you get meet, diagnosing some of their issues by going deep and getting their buy-in fast.

- You’re going to set some boundaries and establish yourself as the authority in the room from the start, not the friendly guy/ girl in the suit or the person who is there to do whatever they say they need.

This strategy session will be structured in a way that is mutually beneficial, leaving them with more than just a signed file note, terms of engagement and a handshake.

Definitely more than just a list of lifestyle goals and objectives and a glossy brochure.

You’ll leave them with a deep and emotional realization about what they need to do (at a strategic level) to get off the financial path they are on, and onto the financial path, they want to get on.

Finally, you’re going to give them a way forward, explaining what you’ll do for them at the end of the appointment there and then, not two weeks later in a document that really should have been part of the conversation.

- Outline their biggest problems as you see them.

- The 2-4 strategies you’d be considering if you were in their shoes.

- Who your firm is built for and why.

- Explain to them how you and your firm think about wealth creation in words that make sense to them.

- Talk them through the process you apply (and not the ASIC one)

- Finally, you’ll outline how you get paid.

Then you’ll invite a decision, and not let them fall back into procrastination again because you have a practiced way of politely drawing out their concerns and objections.

Get this right and not only will you find yourself dealing with clients who you inspired to get advice (instead of you just being in the right place when they came to the conclusion all by themselves), you’ll find yourself able to consistently roll back the fog for each and every client you meet.

Research from Australia suggests that 85% of Australians are there, ready and waiting for leadership out of the epidemic of financial obesity that qualifies for consumerism in a post-GFC society.

They’re looking for relatable financial leadership to light the way.

If that’s not us, who else is going to do it?

ABOUT THE AUTHOR: Stewart Bell is an Australian-based Business Coach and Founder of Audere Coaching & Consulting, a specialist coaching firm working exclusively with advice firms to help them build business models that scale. In addition to working with firms through his Leveraged Advice Firm program, he's also the author of Finnovation: The Complete Advisers Guide to Innovating Your Advice Model and 100 Ways To Run Your Business Better. He shares a lot of what he and program members are doing in trying to build the next generation of advisory business models via his website audere.com.au and YouTube channel art https://goo.gl/8tYfZt

You might want to know Stewart’s thoughts about whether or not to charge for your first appointment.

Therefore, we have a free PDF for you covering Two Very Logical Reasons Why You Should Never Charge for Your First Appointment.

You’ll also receive a free chapter from Stewart’s book: Finnovation: The Complete Advisers Guide to Innovating Your Advice Model and 100 Ways To Run Your Business Better

All you have to do is answer the following question:

What’s Your #1 Problem When it Comes to Engaging Prospects for Your First Appointment?

Just leave your answer by sharing your comment here below, and you’ll instantly receive the two free PDF’s.

Thank you very much for your comment.