Few financial planners enjoy the services of a full team of social scientists to create a great value proposition for their services. So what do you have to do to create one by yourself?

Every financial planner who’s examining his business can sketch profiles of the customer segments adressed therein.

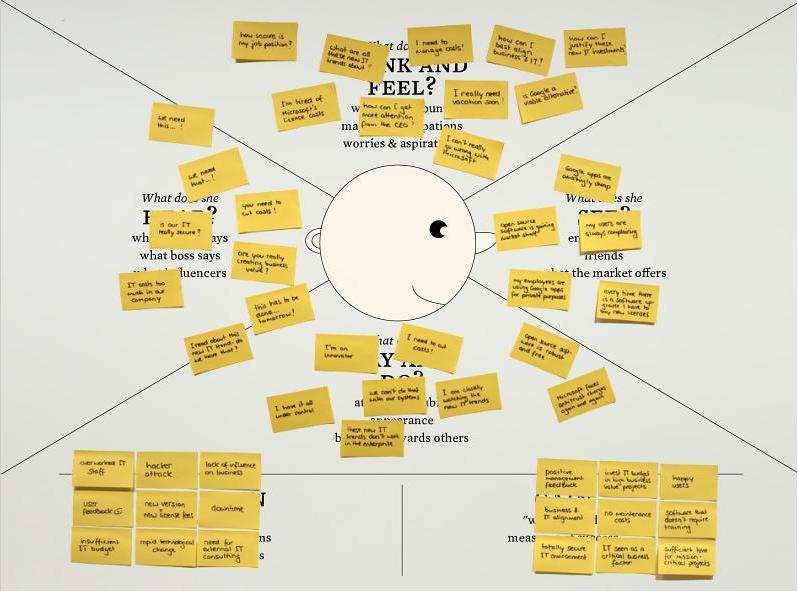

A good way to start is by using the Empathy Map, a tool developed by visual thinking company XPLANE. This tool, which is also called the “really simple client profiler”, helps you go beyond a client’s demographic characteristics and develop a better understanding of environment, behaviour, concerns, and aspirations.

Doing so allows you to devise a stronger business model, because a customer profile guides the design of better value propositions, more convenient ways to reach clients, and more appropriate customer relationships.

Ultimately it allows you to better understand what a client is truly willing to pay for.

How to use the Empathy Map

Here’s how it works. First, brainstorm to come up with all the possible customer segments that you might want to serve. Choose three promising candidates, and select one for your first profiling exercise.

Start by giving this customer a name and some demographic characteristics, such as income, marital status, and so forth.

Then, referring to the diagram used at the top of this page, use a flipchart or whiteboard to build a profile for your newly-named customer by asking and answering the following six questions:

1. WHAT DOES SHE SEE?

Describe what the customer sees in her environment.

- What does it look like?

- Who surrounds her?

- Who are her friends?

- What type of offers is she exposed daily (as opposed to all market offers)?

- What problems does she encounter?

2. WHAT DOES SHE HEAR?

Describe how the environment influences the customer

- What do her friends say? Her spouse?

- Who really influences her, and how?

- Which media channels are influential?

3. WHAT DOES SHE REALLY THINK AND FEEL?

Try to sketch out what goes on in your customer’s mind

- What is really important to her (which she might not say publicly)?

- Imagine her emotions. What moves her?

- What might keep her up at night?

- Try describing her dreams and aspirations

4. WHAT DOES SHE SAY AND DO?

Imagine what the customer might say, or how she might behave in public

- What is her attitude?

- What could she be telling others?

- Pay particular attention to potential conflicts between what a customer might say and what she may truly think or feel

5. WHAT IS THE CUSTOMER’S PAIN?

- What are her biggest frustrations?

- What obstacles stand between her and what she wants or needs to achieve?

- Which risks might she fear taking?

6. WHAT DOES THE CUSTOMER GAIN?

- What does she truly want or need to achieve?

- How does she measure success?

- Think of some strategies she might use to achieve her goals

The goal of the Empathy Map is to create a customer viewpoint for continuously questioning your business (model) assumptions. Customer profiling enables you to generate better answers to questions such as:

Does this Value Proposition solve real customer problems?

Would she really be willing to pay for this?

How would she liked to be reached?

If you have a great value proposition, please don’t hesitate to share it. Please answer this question:

What is your value proposition?

Please, leave your answer here below in the comment field. Thank you very much.

Together we can make financial planning matter.

To your success,

Ronald Sier

If you don’t want to miss the next tip to Make Your Financial Planning Business Matter then please fill in the boxes below and click.

[mc4wp-form]