What if you can save at least 60 minutes worth of explanation, reasoning, justification, comparison and analysis in your client interviews? I believe that in the financial planning business there is still a traditional reasoning-centered approach to selling the service. It’s not strange. Most advisors don’t know about the possibilities of right brain selling. I didn’t for 11 years although I continually studied during this period. Are you still using the traditional approach and therefore missing chances to engage, connect and sell more? The traditional approach follows a linear path which goes like this:

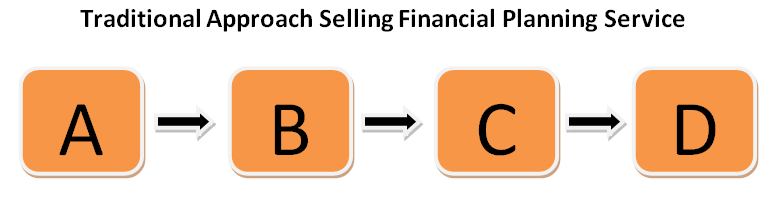

What if you can save at least 60 minutes worth of explanation, reasoning, justification, comparison and analysis in your client interviews? I believe that in the financial planning business there is still a traditional reasoning-centered approach to selling the service. It’s not strange. Most advisors don’t know about the possibilities of right brain selling. I didn’t for 11 years although I continually studied during this period. Are you still using the traditional approach and therefore missing chances to engage, connect and sell more? The traditional approach follows a linear path which goes like this:  Let’s define A, B, C and D as:

Let’s define A, B, C and D as:

A = The service or solution, which we perceive to be the answer

B = Why financial planners think others should buy their service

C = Financial planners add more compelling reasons to buy

D = Get a decision

Financial planners often present a solution (A) that we think or hope will answer client’s needs. We start telling them about features (B) such as taxes, the process or what your sevice is about. Tradtionally, at this point we wait for objections and attempt to meet those objections with more compelling left brain logic (C). Finally, hoping our powers of persuasion and reasoning have prevailed, we invite a decision (D).

A presentation process that relies exclusively on linear left brain logic is inherently flawed. There are 3 reasons for that:

1. it fails because it fails to engage the client’s emotions or imagination. (You’ve got to appeal to people’s emotions. They’ve got to buy in with their hearts and bellies, not just their minds)

2. reasoning-based presentations invite objections

3. step-by-step logical explanations take up valuable time that could be spent listening to your clients

Another problem occurs when we try to get a decision. Clients raise their objections and we answer with more proof. Now their objections go underground and are unspoken. We are now trying to close over these unspoken objections. I believe that this is the reason why clients say they feel pressured to buy something they aren’t sure about. When financial planners tell their clients that they are a Certified Financial Planner CFP), they’re inviting a comparitive objection.

First of all you’re client is probably thinking: “Does that mean anything?”. Second, he’s trying to find an alternative to compare a CFP with. So that you have to explain why a CFP is better than another ‘abbreviation’. Pretty distracting from what you want. You want your client to believe your message so that he’s going to work with you.

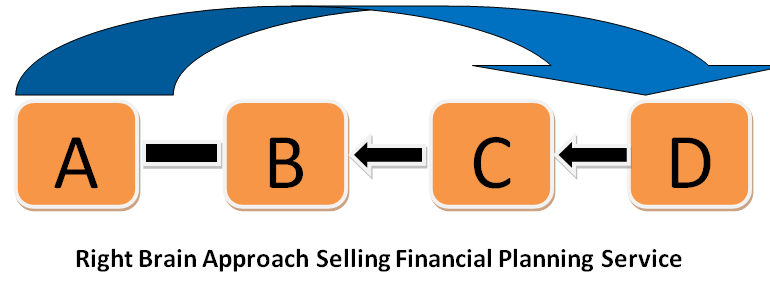

Instead of overcoming objections, you want to move your client past them and go to the emotional or imaginative trigger that causes the decision to be made. I call this the ‘right brain approach’. If you are able to tell a story or share a metaphor, video or illustration that hits the right brain emotional bullseye, it minimizes the need for explanation, justification, comparison and reasoning. If your clients don’t have a good feeling about the idea you’re promoting, all the rationalization in the world won’t alter that feeling. You’ll save yourself time and frustration by using well-timed and clearly targeted videos, illustrations and analogies to enlighten your clients.

The right brain approach begins by making your client feel (by for example sharing a story, metaphor, illustration or video) what your client can achieve (A) and inquire whether your service fits their ‘wants’ (D). If, at this point, clients have questions about particular features and analysis, you can work backword to those areas (B). Why spend so much time explaining details that may not be necessary (C)?

‘A sale is never an exchange of goods, it’s a transfer of emotion’ ~ Seth Godin

Once clients are emotionally secure and calm with your service, the issue is settled. They can take the paperwork home and study it if they wish. The best use of your time is for you to get to know the clients. Effectiveness in using your right brain potential is contingent in part on your ability to empahtize with your clients most pressing intangible wants. Financial planners with a strong social radar (empathy) are best at picking up on what clients’ intangible wants are. Clients don’t come to you simply because they want a financial plan. Rather, clients come to you because they want hope, freedom, status, independence, security, peace of mind, stability and simplicity in financial affairs or any other number of intangible wants. You must develop your right brain to pick up these particular needs. This skill can only be developed by being a totally involved listener tuned in to the emotion of the client. Not tuned in to the assets.

Once clients are emotionally secure and calm with your service, the issue is settled. They can take the paperwork home and study it if they wish. The best use of your time is for you to get to know the clients. Effectiveness in using your right brain potential is contingent in part on your ability to empahtize with your clients most pressing intangible wants. Financial planners with a strong social radar (empathy) are best at picking up on what clients’ intangible wants are. Clients don’t come to you simply because they want a financial plan. Rather, clients come to you because they want hope, freedom, status, independence, security, peace of mind, stability and simplicity in financial affairs or any other number of intangible wants. You must develop your right brain to pick up these particular needs. This skill can only be developed by being a totally involved listener tuned in to the emotion of the client. Not tuned in to the assets.

If you want to know what the 9 Answers Clients Give After Asking What They Want to Feel are, I’ll send you the PDF with those answers. All you have to do is to answer this question:

What do YOU do to appeal to your clients right brain?

Please, leave your answer here below in the comment field. You’ll receive (within 24 hours) a personal email from me with the 9 Answers Clients Give After Asking What They Want to Feel. With your comment you’ll help me and other readers of this blog with insights. So that we can inspire each other and think together to improve and innovate our financial planning business.

To your success,

Ronald Sier

If you don’t want to miss the next tip to Advance Your Client Relationships then please fill in the boxes below and click.

[mc4wp-form]