“If this is going to last any longer, I’m jumping off the roof”

About two years after the birth of my daughter Sanne, my wife suffered severe headaches. At first the headache attacks came once a week. But soon the pain never went away.

Her life became a struggle.

“How to run a family and perform at work with severe-never-ending-headaches while your husband is working” could be the title of her first non-fiction drama.

If the book was written, it would describe how the pain dominated her life for about 1.5 years. One chapter would describe the seemingly endless visits to doctors, hospitals and specialists.

One of those visits was the neurologist visit. Here’s a short story about that visit.

After entering the room, the approximately 55 year-old man grabbed his questionnaire and fired his standard questions at us whilst never looking us in the eye. While he was busy with his two-finger typing at his seemingly 10 year old computer, we had to wait for the next question. His two fingers were too slow.

I looked at my wife and whispered, “Is this really happening?” We left the room, not knowing anything.

The worst was yet to come at our second visit.

“Here’s my diagnosis”, he said. “You have to live with the pain. The only thing I can do is to give you strong medication.”

I asked him, “How can we live with that? She is only 32 years old and she has to raise two very young children.”

He answered, “I’m sorry, there’s no alternative.”

What the neurologist forgot to do

While the neurologist probably thought he was just doing his job very well, he was making a big mistake.

He forgot to put himself in our position and imagine what we were feeling at that moment. But he didn’t stand in our shoes. He didn’t see with our eyes and feel with our hearts.

He forgot to be empathetic.

He forgot to feel with us, sensing what it would be like to struggle through each and every day while raising two kids, working two days a week (which was quite impossible considering the pain), doing the housekeeping, doing the fun stuff, seeing friends and all the other normal things in life.

The same thing happens in our financial planning business. You see, empathy isn’t always valued in our industry. It’s often considered as a softhearted nicety in a world that demands hardheaded detachment. It’s often trivialized as “touchy-feely”.

Most financial planners believe we need to think rationally and logically. Not feel.

We believe we need to strategize, not empathize.

We are trained to prize emotional distance and cool reason. The ability to step back, assess the situation, and give solid advice, unimpeded by emotion.

Because of this training, you probably fall victim to the most disastrous assumption anyone can make about financial planning. It’s an assumption made by all left-brain-planners who want to matter to their clients by helping them with our knowledge.

The fatal assumption is: if you understand the left-brain part of financial planning, you understand what matters most to your clients.

The reason that this is fatal, is that it just isn’t true. In fact, I believe it’s the cause of why financial planners are struggling these days.

If you are still under the fatal assumption that you engage your clients just because of your knowledge, experience or your financial plan, you are just wrong. If you understand the left-brain part of your financial planning services, you understand how the technical part of financial planning is done.

It’s like the neurologist. He believes that by understanding the left-brain part of his medical practice, he’s qualified to do his job.

But in fact, he did a terrible job! He gave us the worst experience I could ever imagine. Come to think of it, I’ve told so many people about our bad experience, he should be glad that I forgot his name!

Now, you might not take my word for it. So let’s see how another highly left-brain industry is evolving to a left and right brain industry.

It’s the medical industry. This industry is beginning to see the limits of a single left-brain-approach. (Thank God…)

How the medical industry evolves to left and right brain care

Yes, it’s true. The curriculum at American medical schools is undergoing its greatest change in a generation.

Here are some stats via A Whole New Mind: Why Right-Brainers Will Rule the Future

- Students at Columbia University Medical School and elsewhere are being trained in “narrative medicine”

- Research has revealed that despite the power of computer diagnostics, an important part of a diagnosis is contained in a patient’s story

- More than fifty medical schools across the United States have incorporated spirituality (!) into their coursework

- UCLA Medical School has established a Hospital Overnight Program, in which second-year students are admitted to the hospital overnight with fictitious ailments with the purpose to develop medical student’s empathy for patients

- Jefferson Medical School in Philadelphia has even developed a new measure of physician effectiveness – an empathy index.

Who would have thought that the medical industry would evolve?

Away from routine, analytical and information based work, toward empathy, narrative medicine and holistic care.

But why is it so difficult for financial planners to evolve?

The problem of today’s financial planner is that you should be two people in one. The Left and Right Brain Planner.

And that’s not easy.

While we have been educated, trained and are forced to develop our left-brain, we didn’t need to develop our right-brain to be meaningful.

People who lean on logic and philosophy and rational exposition end by starving the best part of their mind ~ William Butler Yeats

However, the fact is that we all have a left and a right brain. Except for many of us, it’s not equally balanced. If it was, you’d be an incredibly competent planner.

For example, the right-brain planner wakes up with the big picture. While the left-brain planner worries about the details.

There’s another force at work that makes it difficult for you to evolve to a left and right brain planner. It’s the rule-maker.

The rule-maker forces us to act in a left-brain way. They force us to act within an analytical framework of rules, limits and boundaries. Because that’s “in our client’s best interests”. Except, the rule-makers’ point of view comes from the past. They make new rules because of bad things that happened yesterday. The rules say: Don’t do this or it might happen again.

What the rule-makers do is that they start with the past in mind. How will this ever resonate with us, when financial planning is all about starting with the end in mind?

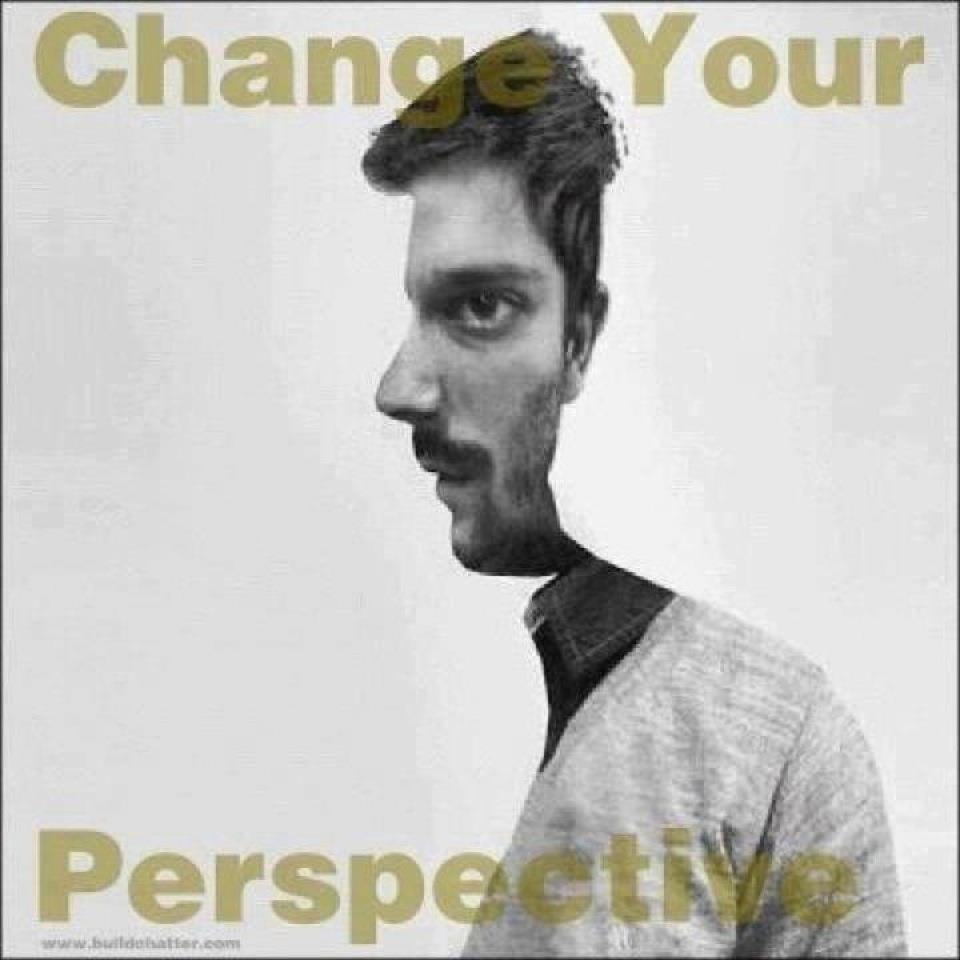

So what if we begin with the end in mind instead of acting from the past? What if we change our perspective?

How to look at financial planning from another perspective

Via The E-Myth Revisited: Why Most Small Businesses Don’t Work and What to Do About It I read a story about Tom Watson, the founder of IBM. When asked to what he attributed the phenomenal success of IBM, he is said to have answered:

IBM is what it is today for three special reasons. The first reason is that, at the very beginning, I had a very clear picture of what the company would look like when it was finally done. The second reason was that once I had that picture, I then asked myself how a company which looked like that would have to act. The third reason IBM has been so successful was that once I had a picture of how IBM would look when the dream was in place and how such a company would have to act, I then realized that, unless we began to act that way from the very beginning, we would never get there. In other words, I realized that for IBM to become a great company it would have to act like a great company long before it ever became one.

What this story tells us is very important. It reveals an understanding of what makes a great business great. It tells us that it’s not only the technical part of the work that’s important. What’s more important is to start with the end in mind and to act with the end in mind.

It says that Tom Watson had a passion for the enterprise itself. In our business, it’s not only the passion for the enterprise that matters. It’s also the passion for the people that matters.

You see, most planners do the work of a planner because they love the work. And that’s great. Because we need to do this work. It’s what we do and what’s necessary to help our clients reach their goals.

But what if your client is not only interested in your work? But more in what you do to give him a great experience, to ask questions that make him think, to inspire him, to make him feel great.

What if we also give attention to this part of our profession, wouldn’t that make our profession far more meaningful?

That’s why I’d like to ask you to look at your work from another perspective:

1.

Don’t ask: “What work has to be done”. But ask: “How does our work matter to our clients?” (take a look at this great article from Blake Fitzgerald for inspiration)

2.

Don’t start with the present, and then look forward to an uncertain future with the hope of keeping it much like the present. But start with the picture of a well-defined future for your client, and then come back to the present with the intention of changing it to match the vision.

3.

Don’t ask: “How can I sell my skills to my clients?” But ask: “How can I create a great experience for my clients?”

4.

Don’t think of the financial plan as the product. Think of the feeling, experience and perception of your client as the product.

5.

Don’t think of your client as a problem because the client doesn’t seem to want what you have to offer. Think of your client as an opportunity

So, to enthuse, inspire and learn from each other, I would like to ask you to finish one (or more) of the following 6 sentences. The first two are on me.

If you do, I’ll give you the 6 Inspiring Statements That Ignite A New Perspective.

I would really appreciate it if you do. Just tell me by leaving your answer – below – in the comment field.

I know how to improve my client’s finances, but I am more interested in helping my clients grow than giving quick fixes

I know that underneath every financial challenge is a human being longing to live a life that’s more meaningful than it was yesterday

I know my stuff, but I …

I don’t use words like “reaching your financial goals” because my goal is …

I don’t strive for perfection, because I know that …

I don’t claim to be an expert about my client’s life, but I …

Please leave your answer – below – and you’ll receive the 6 Inspiring Statements That Ignite A New Perspective.

Let’s make financial planning matter.

To Your Success,

Ronald