Imagine yourself buying something from the internet. How long do you want to wait before enjoying your purchase?

A day, an hour, a minute, a second?

Now, imagine your client buying your financial planning service. How long does your client want to wait before enjoying the benefits of reaching his goals?

Half a century, 25 years, a decade?

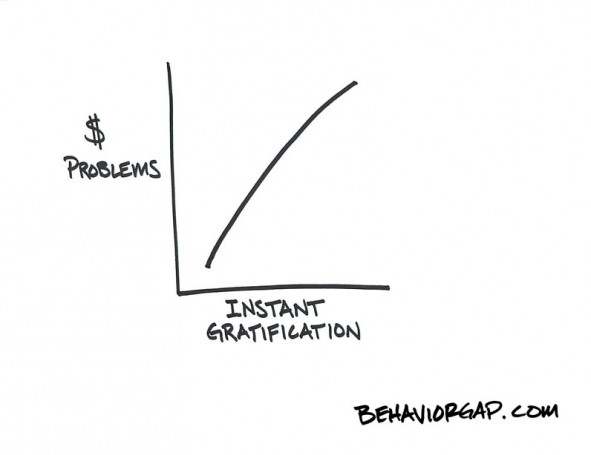

In today’s instant-gratification-world, it takes a behavioral shift to move your clients to think about their future.

So, how do you do that?

Around the world, but especially in the United States, the number of individuals who haven’t made adequate preparations for their golden years, stands somewhere between grim and alarming. About half of U.S. households are financially unprepared for their breadwinners to retire at age sixty-five.

It’s not entirely our fault. Partly because our brains evolve at a time when the future itself was perilous, we human beings are notoriously bad at wrapping our minds around far-off events.

Our biases point us toward the present.

A Not So Adequate Solution

So when given a choice between an immediate reward (say, $1.000 right now) and a reward we have to wait for ($1.150 in two years), we’ll often take the former. Even when it’s in our own interest to choose the latter.

Policy makers and social scientists have devised a few left-brain methods to help us overcome our weakness. Such as automatically deducting a set of amount from every paycheck and funnel it into our retirement account. Or to make our choices and consequences more concrete. For example, by reminding ourselves that the $1.150 we’ll get in two years could be a down payment on a new car to replace our current one, which probably won’t last much beyond twenty-four months.

The Road To The Solution

As Dan Pink points out in his latest bestseller To Sell Is Human: The Surprising Truth About Moving Others (a must-read), the barrier to moving people to save for retirement might be something else altogether. Pink describes a series of studies to test a different hypothesis. In one experiment, participants wore a virtual headset. Half of the participants saw a digital representation of themselves – an avatar – for about a minute and then had a brief conversation with a digital representation of a researcher.

The other half also saw an avatar of themselves through the headset. But for this group, researchers used a computer software package that ages faces to create an avatar that showed what the participant would like at age seventy. This group gazed at the seventy-year-old version of themselves for about a minute and then had the same brief conversation with the researcher’s avatar.

Afterward, the experimenters gave both groups a money allocation task. Imagine, they told the participants, that you’ve just received an unexpected $1.000. How would you allocate the money among the following four options?

- Use it to buy something nice for someone special

- Invest it in a retirement fund

- Plan a fun and extravagant occasion

- Put it in a checking account

Those who saw images of their current selves directed an average of $80 into the retirement account.

Those who saw images of their future selves allocated more than twice that amount – $172.

To determine more precisely what was driving the discrepancy in response – whether it was the sight of their own aging face or the reminder of aging in general – the researchers tried a similar experiment with a different set of participants. This time, half the participants saw an age-morphed image of themselves and half saw an age-morphed image of someone else.

The results weren’t even close.

Those who saw the image of themselves at age seventy saved more than those who’d simply seen a picture of a seventy-year-old.

The Remarkable Solution

The problem we have saving for retirement, these studies showed, isn’t only our meager ability to weigh present rewards against future ones. It is also the connection – or rather, the disconnection – between our present and future selves.

Envisioning ourselves far into the future is extremely difficult – so difficult, in fact, that we often think of that future self as an entirely different person.

To people estranged from their future selves, saving is like a choice between spending money today and giving it to a stranger years from now

What financial planners can learn from this, is that trying to solve an existing problem – getting people to better balance short-term and long-term rewards – is insufficient, because it isn’t the problem that most needs solving.

The researchers identified a new problem: people think of themselves today and themselves in the future as different people.

The solution to this turned out to be quite remarkable: show people an image of themselves getting old.

The effect of this remarkable solution – and actually a funny experience – is, that it encourages people to save more money for retirement. Bank of America is using this technique in a brilliant way. I advise you to check this.

It’s cool, funny, and it’s moving people.

Although the web has some other amazing options to make yourself or your client look old, it can be quite difficult to make it a part of your financial planning process.

That’s why you’d might consider another approach, which is described by Susie Munro from Sixpence Media in this great article. Susie explains that images that represent goals…

- … forces people to become very clear about what they really want to achieve

- … paints a picture of a better reality

- … will emotionally involve people with their goals

This conceptual shift means a new approach to matter, and to move your clients. It’s the capacity to appeal to your clients with a more visual and right-brain approach. It helps your clients to see their situations in fresh and more revealing ways.

Which makes your service far more valuable and unique.

I have a gift for you which helps you to matter and to move your clients. It’s a free PDF about How To Move People With Two Simple Questions

If you want to receive this highly relevant technique – which you’ll most certainly use (really, it’s powerful stuff) in your financial planning practice – all you need to do is to answer this simple question:

What is the biggest problem your clients have with your financial planning service?

Please, leave your answer – below – in the comment field.

You’ll receive the free PDF which shows you How To Move People With Two Simple Questions

To Your Success,

Ronald

If you don’t want to miss the next tip to Make Your Financial Planning Business Matter, then please fill in the boxes below and click.

[mc4wp-form]