“I believe that financial planners will be more successful when using their right brain potential”. Actually it’s strange for me to say. I’ve always been a typical left brainer for years. Good at maths, very rational and successful with study. And always focussing on building knowledge. Because when I finished a study I could say that I achieved something. And that’s very tangible. That’s great, because left-brainers love it when it’s tangible.

I also thought that with this knowledge I could help my clients the most. But after reading Simon Sinek’s book ‘Start with Why’ about three years ago, my perspective changed. The book gave me the urge to search my WHY. And I discovered something I never knew before. Since ‘Start with Why’ I’ve read many, many other business books and found out that almost every successful and innovative influencers (like Seth Godin, Robert Cialdini, Anthony Robbins & Daniel Pink) wrote about the power of the right brain. Since then I can’t stop reading and researching about it. And more important: I’ve applied it in my financial planning profession.

Now, my goal is to inspire other financial planners to believe in their right brain potential. I believe in the importance of the financial planner. Financial planners are by definition highly educated. They have the ambition to reach for the best. And more important: they truly want to help people. Not by selling products. But to give real advice based on what their clients really want. Because financial planners have these strong ambition and are almost always smart people I know financial planners have this right brain potential. When using it right, it’s going to build more profitable and enduring relationships.

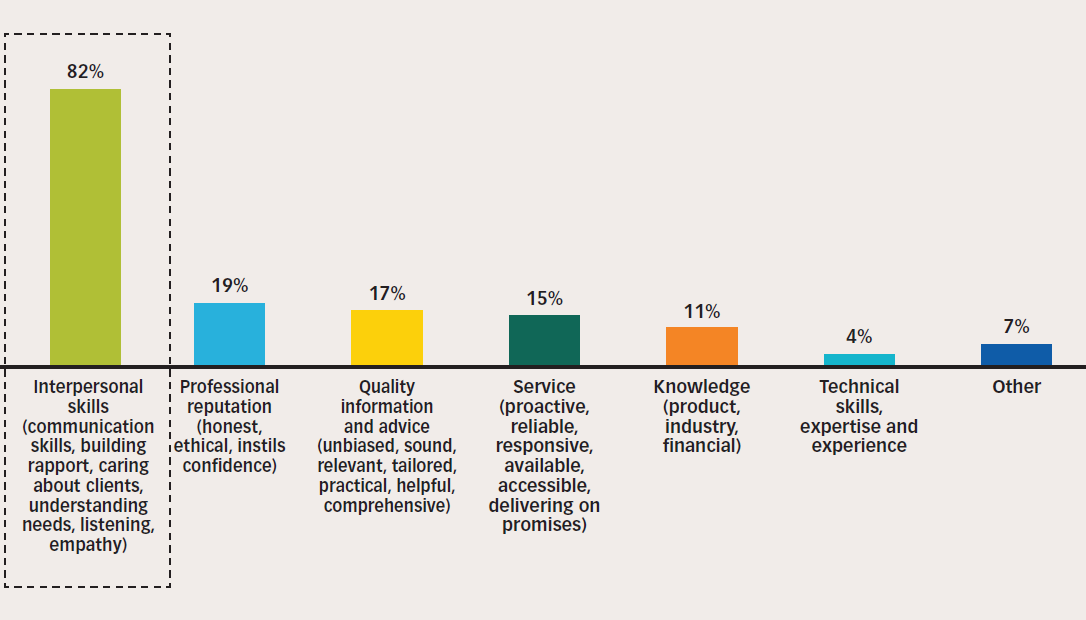

To prove it to you I’m not going to tell you a story, influence you with a metaphor or let you see the big picture. In other words, I’m not appealing to your right brain. To show you that what I believe is true, I’m going to appeal to your left brain in this article. Because I know your left brain asks you to rationalize your choice to work on your right brain potential. And therefore it needs facts and numbers. So please take a look at the picture below.

The picture shows the answer to the following question: “What are the qualities of your advisor that are most important to you? ” It’s part of a client experience survey (white paper) which is powered by Beddoes Institute’s Leading Practices Program (Australia) during 2012. The picture triggered me because of the huge dissimilarity. But after looking at the circumscription, it became clear to me why there was such a huge difference in outcome: the green bar (interpersonal skills) is fully attributable to right brain influence. So let’s take a closer look at what I think can be related to the differente interpersonal skills in the picture:

Communication skills

- Storytelling: the best way to connect to your client is by telling stories. People love good stories and they love it told well. When you say: “Let me tell you a story…” the right side of the brain (as well as the left side of the brain) is at full alert and makes your client sit breathless at the end of his seat to hear your story

- Metaphors: Even Albert Einstein said: “If I can’t see it, I don’t understand it”. Creating metaphors is by definition client centered, since it’s starting point is the client’s current perception. Metaphors help clients see possibilities he didn’t see before and they help him make the best decision. By packaging an idea in highly vivid language, they help him pitch it internally. They help a client feel good about an idea or decision. And that keeps a client coming back

Building rapport

- Feeling of importance: Everybody wants to feel important. Actually, it’s one of the greatest of human needs, up there with food, sleep and sex. While the need for food, sleep and sex are (mostly) easily satisfied, the need to feel important is not. According to Dale Carnegie, writer of the best selling book How to Win Friends and Influence People there are six steps to win friends and make your clients feel important:

- Become genuinly interested in other people

- Smile

- Remember that a person’s name is, to him or her, the sweetest and most important sound in any language

- Be a good listener. Encourage others to talk about themselves

- Talk in the terms of the other’s person’s interest

- Make the other person feel important and do it sincerely

Caring about clients/empathy

- Emotional affirmation: No question is as important as: How do you feel about this? That question is more incisive than: What do you think about this? Why? Because emotion precedes logic when we hear others’ ideas. The choices we make are based on about 80% emotion and 20% logic

Understanding needs/listening

- Ask your clients: do you really know the most valuable things you bring to the relationship with your client? Do you really know why they choose you and why you are meaningful for them? The most simple (but oh so scary) way to understand your clients needs is: ASK THEM. Not only they’ll be surprised – which makes you more referable – but your clients also feel acknowledged

- Context: if context is not clearly established up front, the client will start questioning (internally) the relevance of the various products and ideas you’re talking about. Establish the context at the beginning clearly and continue to refer back to it at key points in your presentation. The right side of the brain wants to know how each peace of text fits into context. If it does not recognize the context, the right side of the brain ignores the information

In the white paper is argued that developing the interpersonal skills provides a clear pathway to becoming a trusted advisor with great client relationships. It also says that technical skills are typically easy to observe, quantify and measure and are the primary target of most training organisations. In contrast, interpersonal skills and emotional intelligence are harder to train but can also be effectively learned and developed with the appropriate training. Importantly, while some advisors are naturally gifted with good interpersonal skills and high levels of emotional intelligence, even the most trusted advisors have, at times, had to work hard to acquire new skills in this area that have not come naturally.

I believe this conclusion is true, but it goes further than that. Financial planners are mostly highly technical people because of their highly (left-brain) education. What I believe is that although financial planners have the highest technical skills in the financial services industry, it doesn’t mean planners can build a profitable business on these skills in the new age. For years a financial planner was highly paid because of their skills and their knowledge. Financial planners were so called knowledge workers because they had information that most people didn’t have. Therefore they could ask for high prices to solve their client’s problem with their information. But with the rise and the role of the internet, this advantage is much less valuable. Knowledge has become a commodity and information is everywhere. Despite of the fact that the knowledge worker has brought the world much wealth, the role of the knowledge worker in the new age will be much less important. Unless the knowledge worker is not going to focus on only knowledge (left brain) but also on emotion (right brain), success will come. As the picture shows, people want to ‘feel’ connected to the financial planner. Your job is to work on those skills to make this connection with your client.

I believe that when you are able to truly connect with your clients by using your right brain potential and continue using your left brain qualities, you’re not only going to be successful. But you are even innovating our business.

What do YOU think is necessary to innovate the financial services industry?

Please, leave your answer here below in the comment field. With your comment you’ll help me and other readers of this blog with insights. So that we can inspire each other and think together to improve and innovate our financial planning business.

To your success,

Ronald Sier

If you don’t want to miss the next tip to Advance Your Client Relationships then please fill the boxes below and click.

[mc4wp-form]