Are you willing to be open and honest with yourself?

Then let’s begin.

Do you think that people consider the financial services industry “remarkable” in the right, positive sense of the word?

I’m pretty sure of the fact that people don’t.

Why?

Because most financial advisors and planners seem to do what we always have been doing, sell what we always have been selling and deliver services like we always delivered services.

And that’s the problem.

The old rule was this: create safe, ordinary services and combine it with great marketing

The new rule is: create remarkable services that the right people seek out

Unfortunately we don’t act on this new rule. Instead, we tend to use poor excuses.

Deniability–“They decided, created, commanded or blocked. Not my fault.”

Helplessness–“My boss won’t let me.”

Contempt–“They don’t pay me enough to put up with the likes of these customers.”

Fear–“It’s good enough, it’s not worth the risk, people will talk, this might not work…”

F.E.A.R. ….. False Evidence Appearing Real ….

Our past brought us compliance. Compliance brought us fear. And fear has the annoying effect that we tend to do the same of what worked in the past.

But doing the same brings us mediocrity. And mediocrity won’t work in the new age, with it’s new rules, new marketing and new economy.

It’s not the path to success.

But hey, we are financial planners. We plan the future. It would be odd if we didn’t have a plan to prepare ourselves for the changing future.

You see, the new age brings huges opportunities for success. And yes, being remarkable is just one of those opportunities.

While just about every planner is petrified of “being remarkable”, you become remarkable with even less effort. If successful new financial planning services are the ones that stand out, and most planners desire not to stand out, you’re set!

But please, act now.

Because now is the perfect time. The market is getting faster and faster. And yes, most people are too busy to pay attention.

But a portion of the population is more restless than ever. Some people are happy to switch their current financial advisor – whatever it takes to get an edge. What you need to do is to create a service so useful, interesting, outrageous and noteworthy that your target audience will want to listen to what you have to say. Or better, to seek you out.

Oh, and before I forget: being remarkable is rewarding. Because the marketplace rewards innovation. They reward things that are new, fresh, remarkable and meaningful.

Being Remarkable Isn’t Difficult

When planners think about “being remarkable” they sometimes believe that you need to invent “the financial-planning-iPad” to actually be remarkable.

This is not the case. Being remarkable can be a small thing. Like Curad did with bandages. They “add a little pizazz to cuts and scrapes”.

The effect? Children say: “I want these bandages”.

Can your create the same effect for your financial planning services?

There is a catch

If it isn’t difficult to create a remarkable financial planning service, why doesn’t every planner do it?

Well, it’s because of the fact that people are afraid. You see, if you are remarkable, it’s very likely that people won’t like you. It’s part of the definition of remarkable. Criticism comes to those who stand out.

So you have a choice:

- to be invisible and safe

- to take a chance and become remarkable

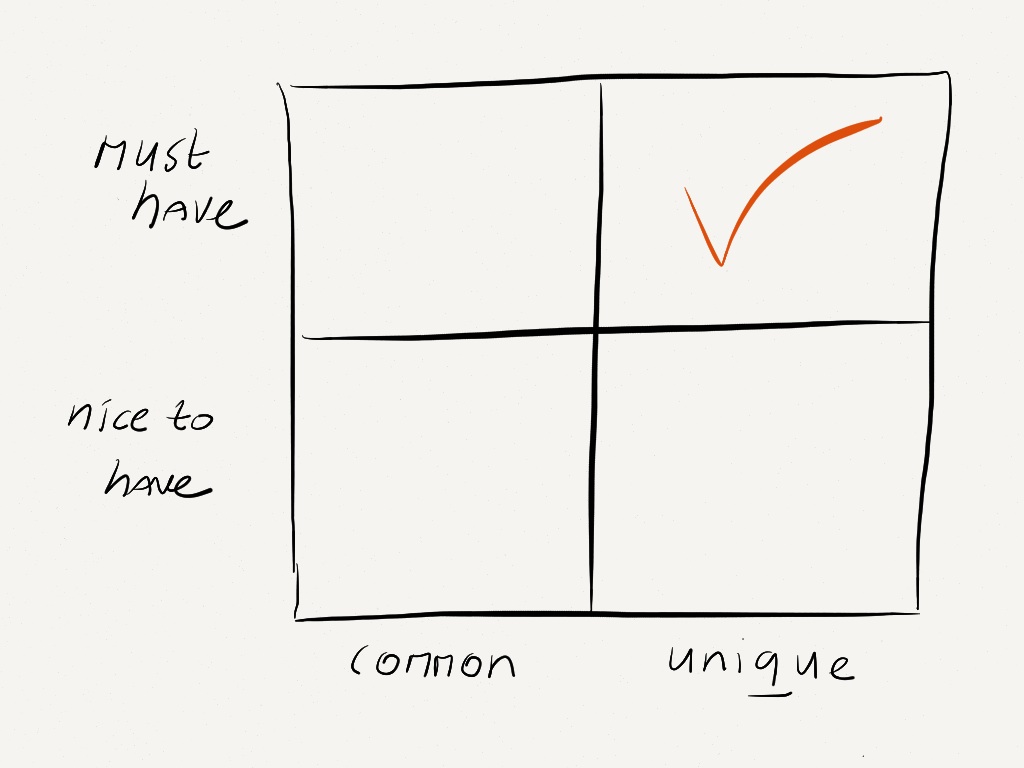

The Remarkable Financial Planning Matrix

The Remarkable Financial Planning Matrix is a tool which helps you to become instantly more desirable.

The matrix has 4 quadrants. The vertical axis represents a regular financial planning service, which is nice to have. And an engaging financial service, which is a must-have.

The horizontal axis represents a common and a unique financial planning service.

These are the basics of the Remarkable Financial Planning Matrix.

Your financial planning service is always in one of those quadrants. In order to find out in which quadrant your financial planning service is, you need to ask yourself two simple questions:

1. Is your service a must-have to your target audience?

For example:

A financial planner who gives financial guidance to every type of client is nice to have.

A financial planner for busy start up entrepeneurs who want advice to minimize risks for their family in less than two weeks, becomes a must-have.

Think about first class fly tickets. Those are expensive, but if you are an international entrepeneur and you need your time in the airplane to prepare yourself for speaking at a important seminar, then first class tickets become a must have. A must-have is about being irresistible to a group of people who want to do business with you.

For which service do you think your prospect wants to pay more?

2. Is your service really Unique?

For example:

A financial planner who presents his financial plan in a paper report is just similar to every other financial planner. It’s common.

A financial planner who presents his financial plan in an engaging video is special and unique.

Think about Volkswage Beetle. Do you remember this (in my opinion) ugly, round and weird car? This car was marketing itself because of the way it looked.

It is a unique car.

When your service is unique and a must have…

…. you hit the jackpot.

When your financial planning service is one of a kind and it solves a real, immediate and painful problem of your target audience, then you are in the right quadrant. You’ll have a remarkable financial planning service.

A remarkable service sells itself. No marketing needed.

Why? Because your clients become fans. And your fans are eager to tell about your service.

Do you want a free gift that helps you to become remarkable?

Great.

If you want to know what it is, please check this video out by clicking on it. It only takes 1 minute and 45 seconds of your time.

If you have been reading my articles lately you might recognize that this video represents my vision of the future of financial planning. It shows you why we need to fulfill our right-brain potential to become highly succesful, to innovate our industry and to matter to our customers in the new age.

Do you believe this message? Do you believe your followers will be enthused about this video?

Then don’t be afraid to share it by clicking one of the social media buttons here at the left.

Thank you.

Now, let’s talk about the gift. It’s another -highly engaging – animation video just for you.

Not only I made this video to empower you to become remarkable. I also created it with the goal to attract your ideal clients (like a magnet) for your financial planning service.

You can use the video immediatly in your business. No strings attached.

And here’s the great news: it’s for FREE.

The only thing you need to do is to answer this question:

What do you (want to) do to make your financial planning service remarkable?

(and if nothing comes to mind, please think of other companies and what you find remarkable about them)

Leave your answer – below – in the comment field.

Let’s make financial planning matter.

Ronald Sier